Bán alu triều chen tại quận Chuyên mua bán tấm alu triều chen tại quận …

Đọc thêm »Ứng dụng của lam nhôm chắn nắng 132Z, ưu điểm, bảng giá mới nhất

Lam nhôm chắn nắng 132Z là sản phẩm lam nhôm chắn nắng được sử dụng khá phổ biến cho nhiều công trình, dự án cần tìm một giải pháp chắn nắng cao cấp, hiệu quả, bền bỉ. Hệ lam nhôm chữ Z được thiết kế hình chữ Z giúp chắn …

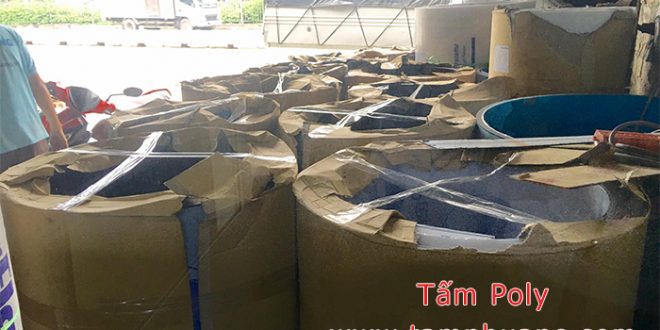

Đọc thêm » Vật Tư Quảng Cáo Chuyên mua bán các loại vật tư quảng cáo giá rẻ trên toàn quốc

Vật Tư Quảng Cáo Chuyên mua bán các loại vật tư quảng cáo giá rẻ trên toàn quốc